The Chapter 13 Interest Rate Committee has met and recommended an increase to the presumptive interest rate in chapter 13 cases. After consideration, the Court has adopted the recommendation of the committee. The presumptive interest rate in chapter 13 cases to be applied to secured claims will become 6.00%, effective for cases filed on or after March 1, 2018. Operating Order 18-01 adopting the new interest rate is available here. The Court thanks the members of the Chapter 13 Interest Rate Committee for their work and recommendation.

You are here

Chambers' Bulletins

Notwithstanding the lapse in appropriations for the federal government, the federal judiciary, including our Bankruptcy Court, remains open and continues to provide all usual services. The Case Management/Electronic Case Files (CM/ECF) system is operational.

The Court will provide additional information as necessary.

The Court has received comments from some attorneys raising concerns about editing limitations in the fillable pdf version of the chapter 13 form plan available on the Court’s website. While the Court’s IT staff will continue efforts to make the fillable pdf form as user friendly as possible, there are unfortunately inherent limitations in the pdf version of the plan which may make editing it difficult. In the event that you experience difficulty using the fillable pdf version of the form plan, the Court recommends using either the Word or WordPerfect version of the form plan. Both are available on the Court’s website on the Local Forms page under the heading “Local Rules Forms.” Please note that due to licensing issues, the Court may not be able to provide future support for the WordPerfect version of the form plan.

The Court has also revised the chapter 13 form plan to correct a scrivener’s error in section 4.4. A check box has been added before the third, “Other Priority Debt” box. This change has been made to all available versions of the chapter 13 form plan.

The Judges are continuing to consider revisions to their Operating Orders regarding conduit mortgage procedures with the hopes of adopting uniform language to be used in plans in conduit cases. Until a revised Operating Order is announced for Judge Duncan, for conduit cases filed on or after December 1, 2017, the following language, also available here, should be included in Section 8.1 of the chapter 13 form plan:

8.1 (a) Mortgage payments to be disbursed by the Trustee (“Conduit”):

Mortgage payments, including pre-petition arrears, will be paid and cured by the Trustee as follows:

|

Name of Creditor |

Description of Collateral (note if principal residence; include county tax map number and complete street address) |

Current installment payment (ongoing payment amount) * |

Monthly payment to cure GAP ** (post-petition mortgage payments for the two (2) months immediately following the event beginning conduit) |

Estimated amount of PRE-PETITION ARREARAGE** (including the month of filing or conversion)* |

Monthly payment on pre-petition arrearage |

|---|---|---|---|---|---|

|

|

|

$ Escrow for |

$ |

$ |

$ |

|

|

|

$ Escrow for |

$ |

$ |

$ |

* Unless otherwise ordered by the court, the amounts listed on a compliant proof of claim or a Notice filed under FRBP 3002(c) control over any contrary amounts above, and any Notice of Payment Change that might be filed to amend the ongoing monthly payment amount.

** The Gap will be calculated from the payment amounts reflected in the Official Form 410A Mortgage Proof of Claim Attachment and any Notice of Payment Change that might be filed to amend the monthly payment amount, but should not be included in the prepetition arrears amount.

All payments due to the Mortgage Creditor as described in any allowed Notice of Post-petition Mortgage Fees, Expenses, and Charges under F.R.B.P. 3002.1, filed with the Court, will be paid by the Trustee, on a pro rata basis as funds are available. See the Operating Order of the Judge assigned to this case.

Once the trustee has filed a Notice of Final Cure under F.R.B.P. 3002.1(f), the debtor shall be directly responsible for ongoing mortgage payments and any further post-petition fees and charges.

Amended Chambers Guidelines for cases assigned to Judge Duncan, effective December 1, 2017, are available here and will be posted soon on the Court's webpage.

A further revised Operating Order 16-02, for chapter 13 conduit mortgage plans or a new order, will be entered and published soon and you will receive separate notice of entry, or interim language that is acceptable for inclusion in section 8 of the chapter 13 form plan in cases assigned to Judge Duncan until the new Operating Order is adopted. Judge Duncan is awaiting the results of the divisional workshops being hosted by Judge Waites and Judge Burris and hopes to have uniform language.

The Judges met and considered comments received to the proposed local rules. Upon agreement of the Judges, the following rule changes will be effective December 1, 2017. The changes are summarized as follows:

1. All exhibits have been removed from the Local Rules and will instead be placed on the Court’s Locally Maintained Court Forms page. Each form associated with a Local Rule will be accessible through a hyperlink in the relevant Local Rule. Local Rule 1001-1 was amended to replace references to exhibits to references to local forms.

2. Local Rule 2016-1(b)(1) was amended to remove the requirement that the amount of attorney’s fees agreed upon between the attorney and the debtor be stated in the chapter 13 plan.

3. Local Rule 2082-1 was amended to reference family fishermen, in addition to family farming operations. The chapter 12 plan was substantially revised. Motions to value or avoid liens can now be contained within the chapter 12 plan.

4. Local Rule 2090-1 was amended to require a party moving for pro hac vice admission to file a new local form with their motion. The local form requires that the applicant agree to abide by local rules and Chambers’ Guidelines as well as set forth their proficiency in bankruptcy law and procedure.

5. Local Rule 3015-1 was revised to require the local form plan to be used as the form for any plan filed in a chapter 13 case.

6. Local Rule 3015-2 was substantially changed. Modifications before confirmation require that the debtor file and serve the form plan, along with, if necessary, a local form Notice of Confirmation Hearing. Post-confirmation modifications to a chapter 13 plan now require a motion to modify, as set forth in subsection (b). Finally, plan payments may now be increased by the filing of a stipulation between the debtor and the trustee.

7. Local Rule 3015-3 was amended to clarify the Court’s revised procedures regarding scheduling of confirmation hearings and confirmation of plans.

8. Local Rule 3015-6 was amended to delete subsection (d). If an objection to a proposed interest rate is filed, the objection will be considered at the confirmation hearing. No response by the debtor is necessary.

9. Local Rule 4003-2 was amended to remove reference to chapter 12, since motions to avoid liens can now be included in a chapter 12 plan. The procedure for obtaining an order that a lien has been satisfied in a chapter 13 case was removed from the Local Rule, as it is now governed by Fed. R. Bankr. P. 5009(d).

10. Local Rule 5075-1 was amended to delegate additional matters for notice: (1) ballots for a chapter 11 plan to the proponent; (2) notice of confirmation hearing in chapter 12 or 13 to the debtor; and (3) order declaring that a secured claim has been satisfied or lien avoided in a chapter 12 or 13 case to the debtor.

11. Local Rule 9013-4 was amended to add motions to modify confirmed chapter 13 plans and motions pursuant to Fed. R. Bankr. P. 5009(d) to the passive list and motions/applications nunc pro tunc to the non-passive list.

12. Local Rule 9018-1 was amended to allow paper copies of sealed documents to be destroyed 2 years after the closing of the case, if the documents have been electronically filed.

13. Minor amendments were made to other rules and forms. Several forms were revised to conform to Fed. R. Bankr. P. 9009 and the respective Official Form.

The Judges thank those practitioners and parties who provided comments, as well as the following members of the Local Rules committee:

- Kathleen M. Muthig

- John Timothy Stack

- Katherine L. Rea

- Michael Kevin McCarrell

- Russell A. DeMott

- Michael H. Weaver

- Christine E. Brimm

Please see the attached order regarding the Court's schedule for the upcoming holiday season and for computing time during that period.

Remarks from Judge Waites:

I salute the Court’s recognition of the service of Judge Thurmond Bishop from 1987 to 2006. I was very fortunate to serve as his colleague for my first 12 years on the bench and learned a lot from him. I know the lawyers that appeared before him agree with me that his keen intelligence, dry wit and sense of humor, his focus on fundamental fairness and old fashioned common sense made him an outstanding judge. During his tenure, he handled some of the largest chapter 11 cases filed in this District, and was rated as one of the best bankruptcy judges in the country by one publication. At one point after the retirement of Judge Davis, Judge Bishop and I carried the largest caseload per judge in the country, but with frequent communication and the help from staff and the Clerk’s office, we never felt overwhelmed.

I benefited from and miss our frequent lunches where we reviewed everything from our cases, to politics, news, sports and the latest family news. I was truly blessed to have his support and friendship over the years, as well as the closeness of our families, who grew up and were often together during our years on the bench.

I know Judge Bishop always enjoys a call or visit if you are near Abbeville, so I encourage you to let him know he is missed.

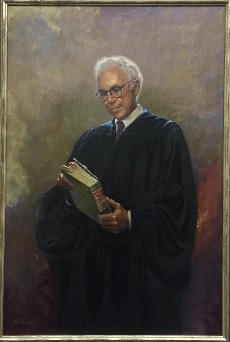

Wm. Thurmond Bishop was sworn in as United States Bankruptcy Judge for the District of South Carolina on October 30, 1987, thirty years ago today. He served as Chief Judge from 2000 - 2006. Upon his 2006 retirement he resumed the private practice of law in his hometown.

| In Memoriam: | J. Bratton Davis | ||

| United States Bankruptcy Judge | |||

| 1917-2004 |

Remarks from Judge Waites:

In honor of what would be his 100th birthday, I wanted to follow the Court’s announcement and share a few personal remarks about my friend and colleague, J. Bratton Davis, this District’s first bankruptcy judge.

For those of us who worked with him or practiced before him or otherwise knew Judge Davis, we remember him as a great jurist but an even better person—always gracious, loyal, kind and caring. If you did not have a chance to meet him, know that he laid the foundation for all that is good about our Court and practice, including the highest standards for public service, fairness, collegiality and civility. I encourage you to ask almost any of the long-tenured practitioners, judges or trustees in this District to share their memories of him so you may learn what a lasting legacy he has left.

His tenure and accomplishments are inspiring and were celebrated on the occasion of his retirement in a special session of the Court honoring him, the minutes of which were published nationally in volume 284 of the Bankruptcy Reporter. I invite you to review a copy of the minutes of this special session, which are available here.